George users have set aside over 1 billion CZK with the Roundup Savings feature. George’s Product Owner for Financial Health, Carina Haberfellner, reflects on this milestone.

At George, we’ve been working hard to build tools that genuinely help people take control of their financial wellbeing. It’s a core part of our mission in the Financial Health team — and something I care deeply about as a product owner. Financial education should be accessible to everyone, and my team plays a key role in supporting users on their path to financial wellbeing. That’s why we develop solutions that encourage action, simplify saving, and promote healthier financial habits.

Saving doesn’t need to feel like a big decision or a sacrifice.

One of our most impactful innovations, Roundup Savings, has now reached an incredible milestone: our users have collectively saved more than 1 billion CZK (approximately 40 million EUR) in just over a year since the feature launched at Česká Spořitelna. When we launched Roundup Savings, we hoped it would help people start saving without friction. Seeing it grow to over 1 billion CZK saved in just a year — with over 250,000 active users — has been an amazing validation of that idea. It shows how small, consistent actions can lead to significant financial progress.

Small Steps, Big Impact: The Power of Roundup Savings

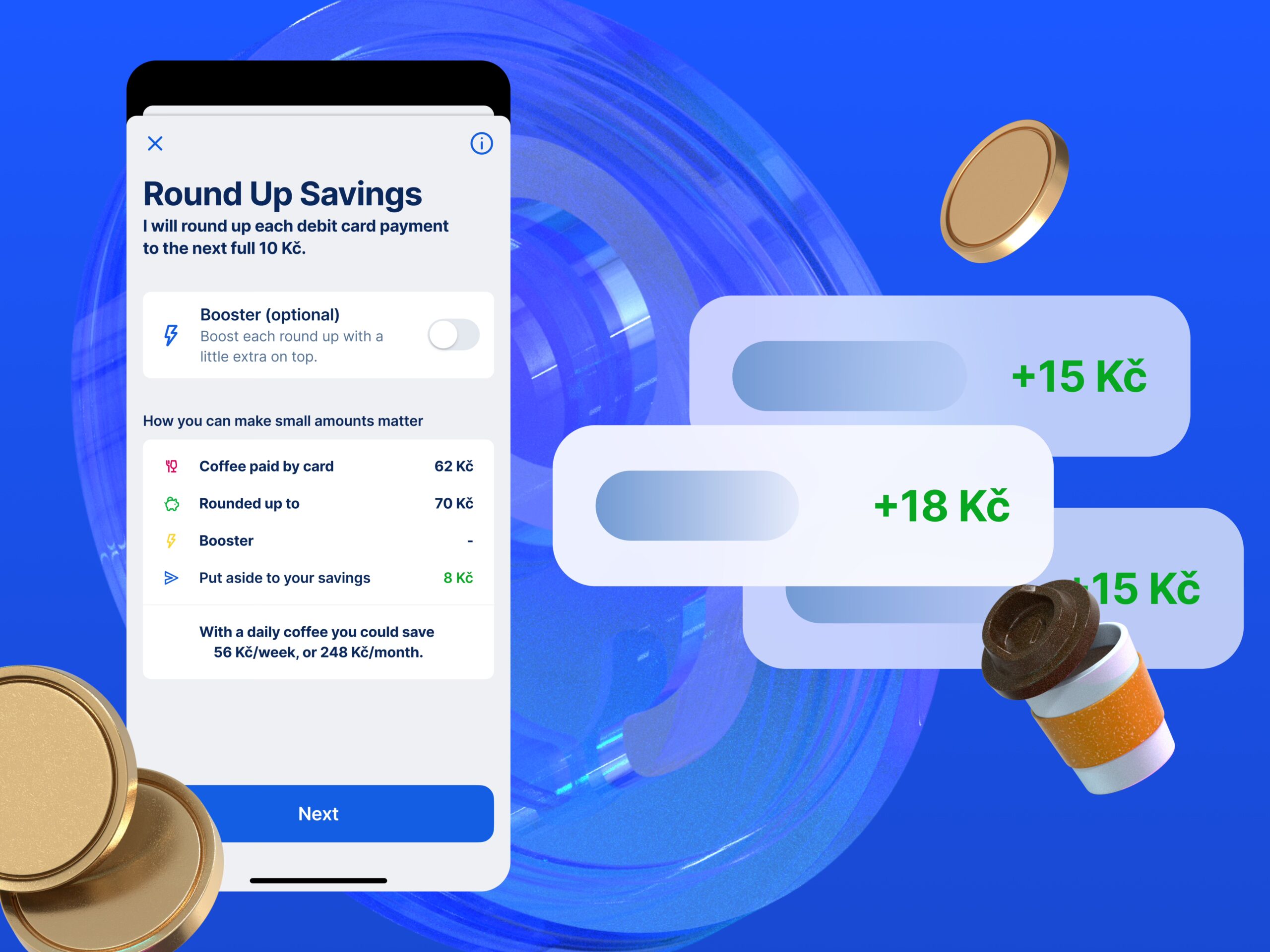

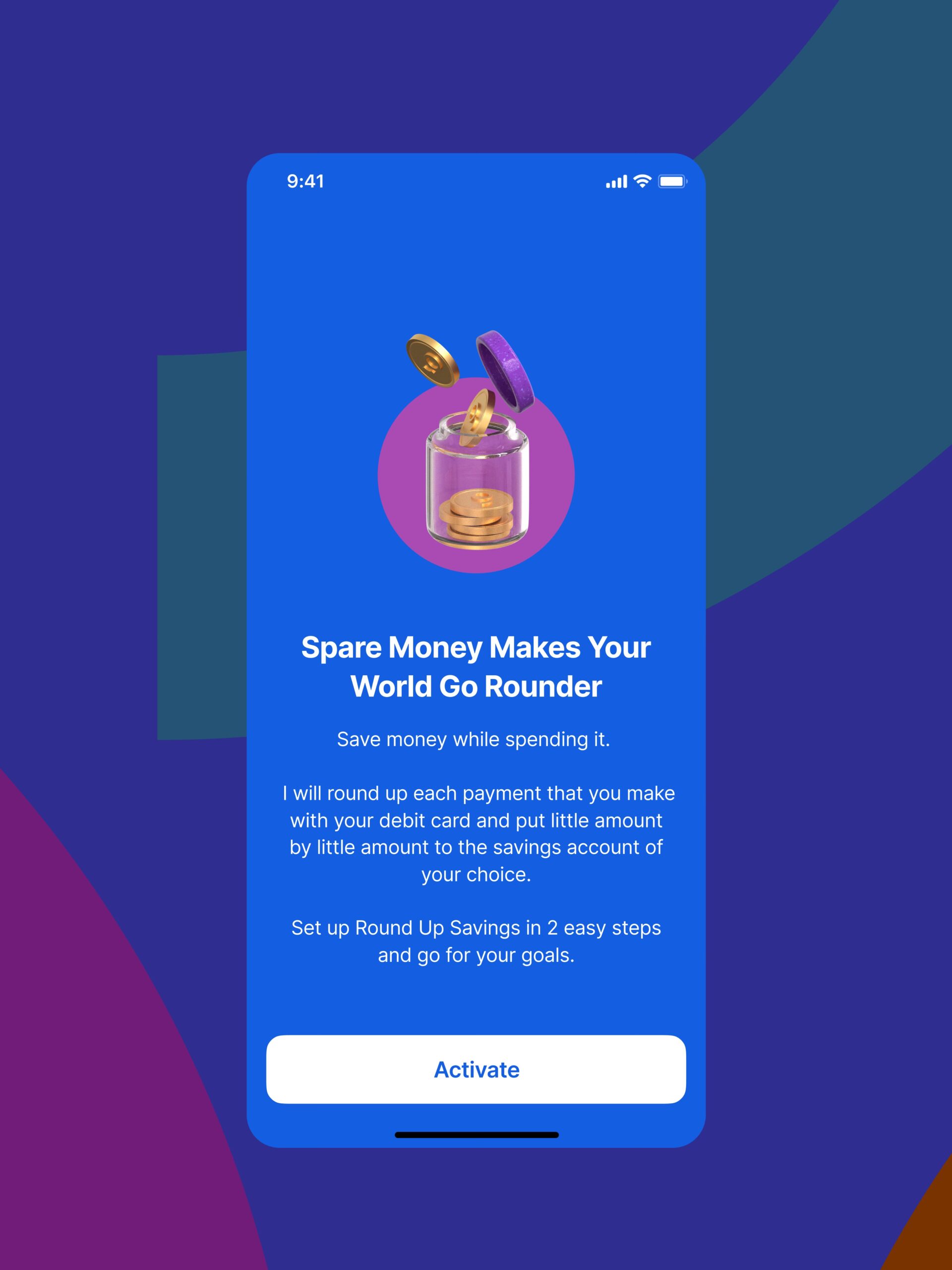

We designed Roundup Savings to make putting money aside effortless — and to show that saving doesn’t need to feel like a big decision or a sacrifice. Every time a user makes a purchase, the amount is rounded up to the nearest whole number, and George automatically transfers the difference to the user’s savings or investment account. This simple yet effective automation encourages users to set aside funds consistently without even thinking about it. These small changes in daily financial behaviours can accumulate into meaningful financial growth over time.

Our goal wasn’t just to build a feature — it was to shift the mindset around saving altogether.

A key part of our mission is helping people who haven’t yet started saving take their first steps towards financial security. By making the process easy, automated, and engaging, we aim to lower the barriers to action and help more people build a solid foundation for the future.

The overwhelming response to Roundup Savings at Česká Spořitelna has paved the way for further expansion. The feature is now available at Banca Comercială Română and Slovenská Sporiteľňa, with upcoming launches at Erste Bank Hungary and Erste Bank Croatia. Meanwhile, at Erste Bank Österreich, Roundup Savings has long been a customer favourite and will soon get a fresh look and feel.

Beyond Roundup Savings: The Future of Money Automation

Roundup Savings is just one part of our broader vision for financial health and a stable financial future. We’re always working on new, intuitive features that make managing money easier and more personal. Soon, we’ll introduce even more playful and intelligent money automation features, further streamlining the process of putting money aside—whether for savings or investments.

From the beginning, we knew that smart automation would be key. Our goal wasn’t just to build a feature — it was to shift the mindset around saving altogether. By reducing the effort required to set money aside, we make it easier for customers to build healthy financial habits. Our goal isn’t just to build tools, but to make saving feel like second nature.

Small, consistent actions can lead to significant financial progress.

A Commitment to Financial Well-Being

At the Financial Health Cluster, we see financial education as essential to our work. Building innovative features is only part of the story—making sure that customers can use them effectively is just as important. That’s why we’re committed to providing practical guidance on financial habits, helping people feel more confident and in control of their money.

As we celebrate this milestone, we remain focused on our purpose: building smart, automated solutions that help people take meaningful steps towards financial security. The journey to better financial health begins with small, manageable actions. Financial literacy is something that can be taught, and with tools like Roundup Savings and other upcoming features, we’re making it easier than ever for customers to build a healthier financial future.

Our goal isn’t just to build tools, but to make saving feel like second nature.

Here’s to the next billion CZK saved and to a future where financial education is a feature, not an afterthought. As a product owner, moments like this — where we see real impact at scale — are what keep me motivated. We still have a lot more to build. But this milestone reminds us that simple tools, when designed well, can transform people’s relationship with money.