George is already well known and trusted by more than 9 million people in 6 countries. Now, for the little ones too, there is George Junior as a companion through their beginning money life. The launch in Romania marks the beginning of a new era that will continue in other countries in the future. Learn more about the background and why financial education is important, especially for children.

It is necessary to introduce children to banking at an early age, as this allows them to develop important financial skills and learn how to handle money. That’s why financial education can’t start early enough. Even at a young age one can learn through play and with a joy of discovery. And this is where George Junior comes in. As one part among many that helps to guide children into their financial future.

There are good reasons why children should get to grips with their money lives at an early age. After all, most of them get pocket money, so they automatically have to deal with it.

What is important for children’s money life

- Financial education: By introducing children to the world of finance at an early age, they develop a basic understanding of financial concepts. These include saving, budgeting, interest rates and how debt is created. This knowledge is important for children to make good and wise financial decisions when they reach adulthood.

- Encourage saving: A bank account helps children save money and practice saving. When the money is in the bank, the temptation to spend it immediately is no longer so great. Therefore, there is more focus on longer-term goals.

- Digital literacy: In today’s digital world, online banking and online payment methods are part of everyday life. Familiarity with online banking applications helps children develop digital literacy and navigate the internet.

- A sense of responsibility: By setting up an account and managing their own money, children learn responsibility and independence. In doing so, they also learn how to keep and manage their money safely and how to protect it from loss.

- Financial goals: The bank account is a good tool for setting and following up financial goals. Children can learn to set long-term goals, e.g. for their first motorbike, moving out of home or going on a trip with friends.

This is where George Junior comes in

George Junior unites all these important points. With the help of George Junior, children can manage their pocket money or the money given to them by their grandparents as a birthday present. They also learn how to handle it independently, set goals and do some planning. George Junior provides many tips and tricks about financial life. And on top of that, there are explanations of financial terms and support on the way to achieving one’s savings goals.

Learning should be fun. For example, with regular fun facts about money.

George Junior supports kids and their parents

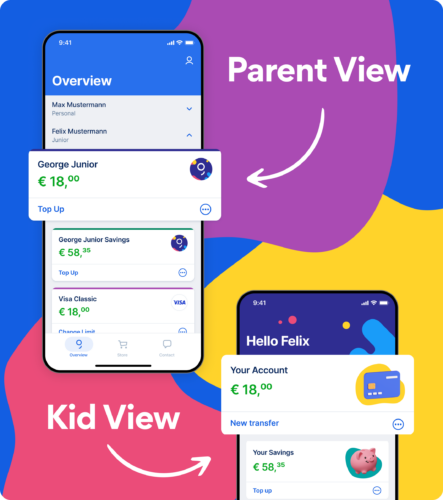

To accompany children – together with their parents – on the way to more financial education, George Junior has recently been launched. The first Erste Group country to offer it is Romania. With more to come in the future. The George Junior app is linked to the parents’ George account. This way, they can always keep an eye on their children and support them on their financial journey.

George Junior is an app for young people who are learning to manage their money on their own.

The aim of the project was to create an online account for children and young people between the ages of 7 and 14. The George Junior app helps children do things their way, in one place. And to support them on their way to learn more about money management. With George Junior, they can organise their money according to their priorities: withdraw money from the ATM, pay with their card or save for what they want. And this always in the company and with the support of their parents and George Junior.

What makes George Junior special?

George Junior: connected to the parent’s George account, secure and educational

Designing a banking app for children is not about making things smaller and easier to understand. It is also about listening to children’s specific needs and interests and creating a product that is both engaging and educational, as well as safe and reliable. You also have to take into account children’s cognitive abilities, attention span and needs.

“By taking the time to understand the needs of both children and parents, we can develop products that are enjoyable and useful for everyone involved.”

Zsolt Aranyosi, Product Owner, George Junior

Children are capable of more than we often think

As we noticed during the testing and implementation phase, we can trust children with much more than we imagined. It is not necessary to simplify terms that are normal in adult banking, such as current account, savings account, etc. The point is to explain things with examples, not to use complex sentence constructs, and not to complicate anything. But that’s how banking should be for everyone anyway. After all, who wants to make their life more difficult than necessary?

Too address the needs of children, it was also important to make the design appealing. Especially for those who have not been able to read for too long, visuals make a big difference. Children are always curious and not afraid to try things out if they are not quite sure about something. This should be considered, so they don’t lose the joy of learning and enjoy dealing with their finances. After all, using their own banking app shouldn’t be compulsory. It should give them the feeling that they are achieving something. Be it saving or learning new things and skills.

Dealing with money is learnable

An early introduction to money management and financial education helps build financial skills and competencies. Children can use these throughout their lives to be more successful and responsible. It is particularly important to design these lessons gently and in an age-appropriate way so that children learn to understand the basics and feel confident in dealing with money. So that handling their money is natural for them and not something that seems complicated or scares them.